September has garnered an unfortunate reputation in the finance industry for being a notoriously difficult month to navigate. The “September Effect” generally focuses on the idea that S&P 500 returns have been weaker on average in September than in any other calendar month. And while this may be true, there’s a lot that can happen during any given September.

Thus far, September 2025 has a lot going on!

As of Sept 23, the S&P 500 is up about 3% during the month. That certainly bucks the historical narrative that September can be a tough go! However, the month isn’t over yet, and there’s plenty of economic data to sift through.

Key Takeaways:

September defies expectations: The S&P 500 gained around 3%, breaking the usual negative “September Effect.”

Fed rate cuts likely: The Federal Reserve is expected to lower interest rates multiple times to support the economy.

Job market softens: Slower job growth and rising unemployment signal weakening employment conditions.

AI disrupts entry-level jobs: Artificial intelligence is accelerating job displacement, mainly in entry-level roles.

Supportive policies boost outlook: Fiscal stimulus and lower rates provide a positive backdrop despite labor market concerns.

Will the Fed Lower Interest Rates?

The Federal Reserve’s FOMC met on September 16-17 and delivered a widely expected rate cut of 0.25% while strongly suggesting rate cuts are on the table at the next two meetings of the year (10/29 and 12/10). If the Fed cuts rates by 0.25% at each of these three meetings, the target overnight rate will range between 3.5 to 3.75%. While this may not have direct implications for mortgage rates, it should help grease the gears of corporate America’s ability to borrow at lower rates.

The reason the Fed would be moving to cut interest rates (if that is indeed the path they follow) isn’t so much due to inflation. Inflation has been relatively tepid, all things considered. Tariffs haven’t placed significant upward pressure on imported goods for the short period of time they’ve been in place, and shelter costs have cooled from the year prior, which has helped offset any price pressure that has materialized. Rather, the Fed would be moving to loosen monetary policy due to the weakening employment picture.

Warning Signs Emerge in the Job Market

For the past few months, the employment picture has been deteriorating. We haven’t arrived at “a point of no return” by any means. We’re still adding jobs throughout the economy, and there are still millions of job openings available. The issue is more so the number of jobs added is slowing, and revisions of prior data suggest the employment picture isn’t as rosy as it once seemed.

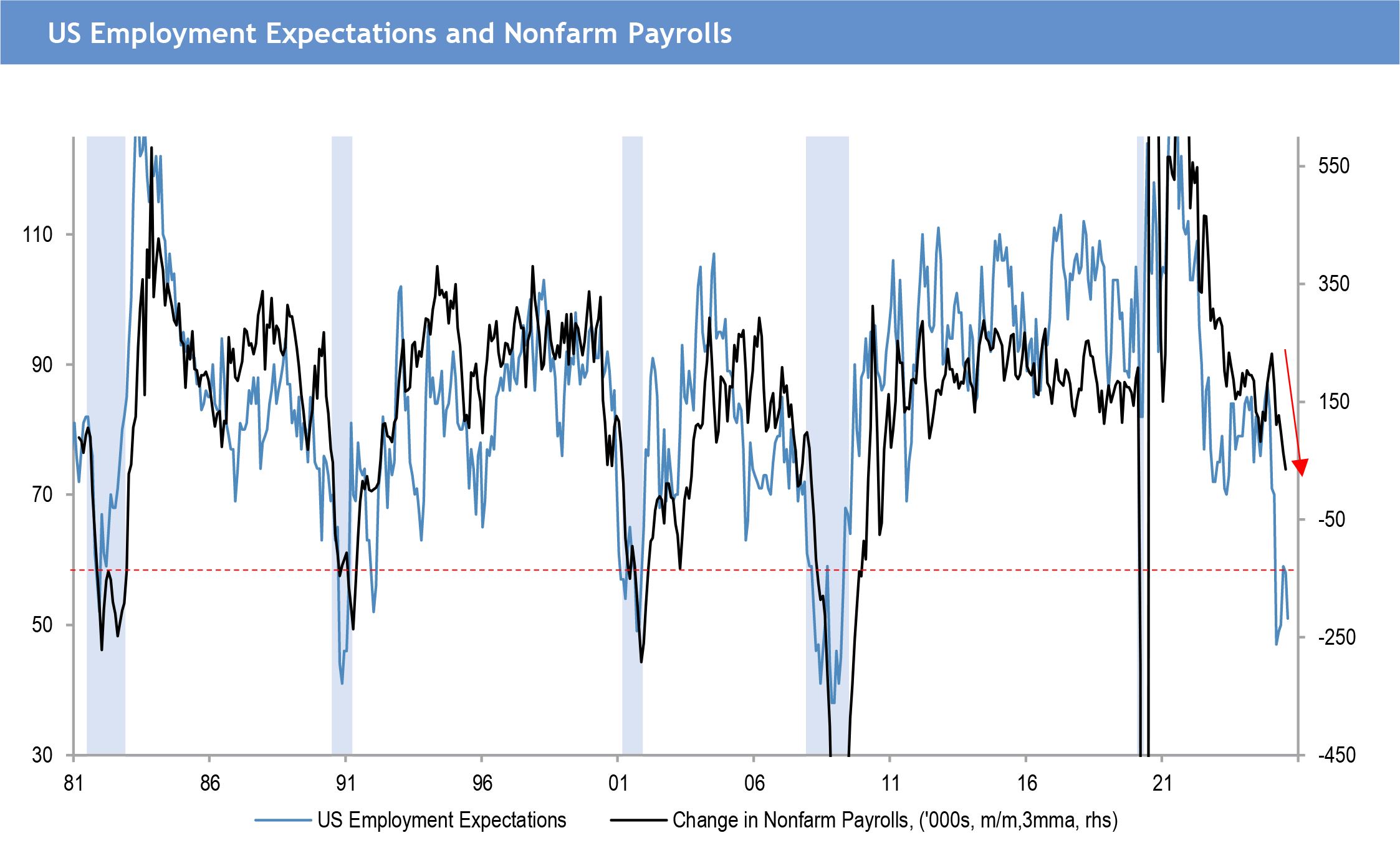

Specifically, when we look at what employment expectations look like vs. the number of jobs added each month, we can clearly see the sentiment around job creation has become quite somber. The chart below shows employment expectations dislocating from the trend of positive job growth since the beginning of the year. This expectations survey tends to be a leading indicator of job growth, which suggests there might be further room for job creation to fall in the coming months.

(Source: JP Morgan)

Separately, individuals accessing unemployment insurance has slowly crept higher since the beginning of 2024. There are a few reasons why unemployment could be moving higher. Individuals who were not seeking a job previously could now be reentering the market for a job and claiming unemployment insurance. Skilled workers may also struggle finding jobs in their specific field or work as companies become stricter in their hiring practices. We’ve seen the unemployment rate increase during this time as well, moving from 3.8% to 4.3%.

How Is AI Affecting Unemployment?

What’s less apparent is how much artificial intelligence (AI) is replacing entry level jobs. A recent study from Stanford suggests that entry level jobs are being displaced at a greater rate on average than jobs that require greater skill and experience to complete. There’s no doubt AI and the loss of job opportunities will be something our economy will need to reconcile in the not-too-distant future.

The good news is despite a weakening employment picture, the monetary and fiscal policy presently in place paints a very supportive backdrop for the economy moving forward. Stimulus from the One Big Beautiful Bill Act will begin making its way into the economy over the next few years. Interest rates are coming down, creating a tailwind for consumers seeking to borrow for purchases or businesses seeking to expand for projects. And while a greater share of consumer spending is coming from the wealthy, we see little reason to be concerned with the aggregate picture of consumption.

Individuals showing a CFP® designation hold an active CERTIFIED FINANCIAL PLANNER™ certification. To earn the CFP® designation, the individual had to complete an approved educational program, pass a rigorous examination and meet stringent experience requirements. Designation holders also adhere to a professional Code of Ethics and fulfill annual continuing education requirements to remain aware of current planning strategies and financial trends. You can find more information about this designation at CERTIFIED FINANCIAL PLANNER™ (CFP®) Certification.

Individuals showing a CFA® designation hold an active CHARTERED FINANCIAL ANALYST™ certification. To earn the CFA® designation, the individual had to complete an approved educational program, pass a rigorous examination and meet stringent work experience requirements. Designation holders also adhere to a professional Code of Ethics and fulfill annual continuing education requirements to remain aware of current planning strategies and financial trends.