The Economic Landscape

Many believe that the ability to preserve wealth will be increasingly difficult in the future. These concerns stem from challenges facing the United States.

- National Debt

- Changing Public Opinions

- Changing Demographics

Understanding the headwinds created by these challenges is critical.

Challenge One – Headwinds Created by National Debt

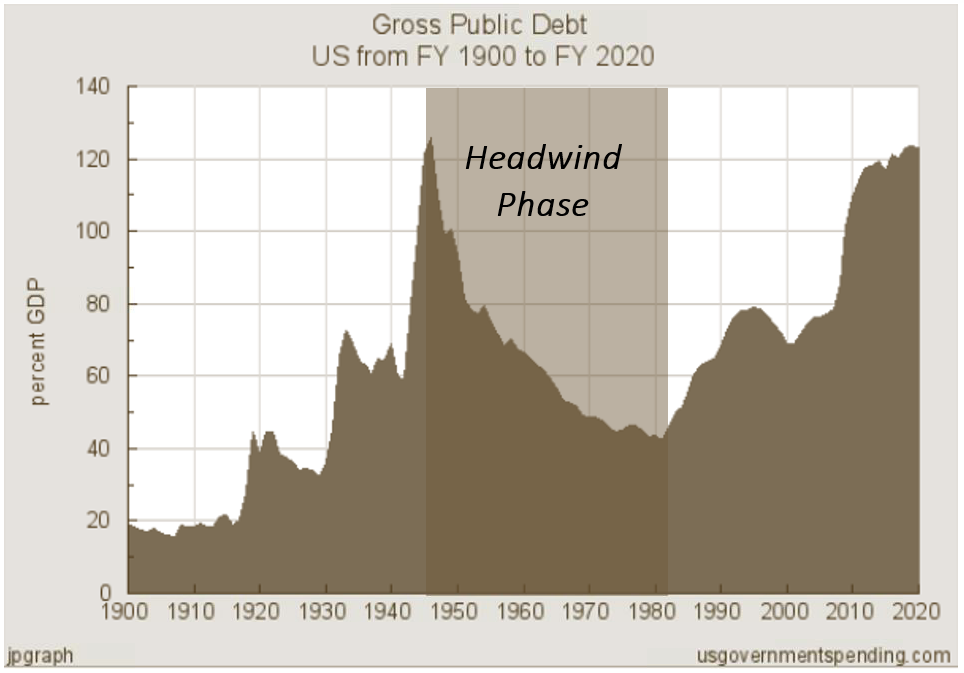

To understand future headwinds stemming from national debt, the past must be understood.

In 1945, the national debt was proportionally similar to the present when compared against the size of the economy. To reduce national debt, out of necessity, the government implemented strategies over the next 38 years which helped reduce debt to a more manageable level.

These government policies during the 1945-1982 period created two major headwinds: higher taxes and higher inflation.

Tax Headwind

This graph illustrates the average highest marginal federal income tax rates during the headwind phase from 1945 to 1982, when the top marginal income tax rate for individuals averaged nearly 80 percent, versus the years since then during a time of expanding debt reliance:

Source: Tax Policy Center

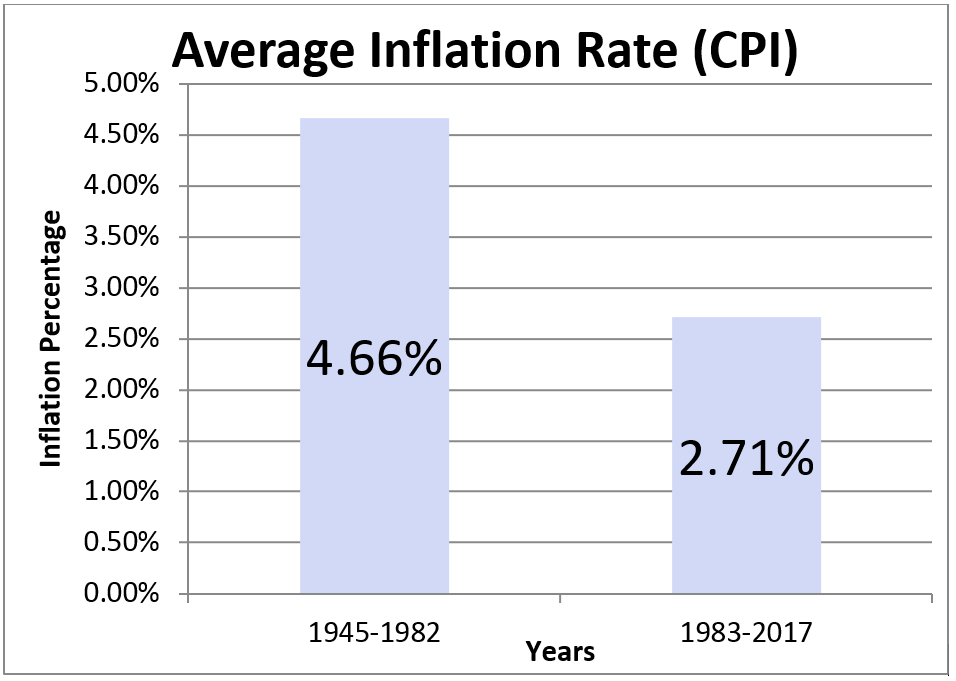

Inflation Headwind

The following graph shows the average inflation rate during these same time periods. Many attribute some of the elevated inflation during this headwind phase to governmental policies which accommodated expanding the money supply; high inflation can devalue the national debt in real terms. Unfortunately, inflation can negatively impact unprepared investors while quietly eroding lifestyles.

Source: www.inflationdata.com

Challenge Two – Headwinds Created by Changing Public Opinions

There is a growing acceptance that the wealthiest Americans should shoulder the burden of America’s economic woes. A 2016 Gallup Poll asked the question: “Do you think our government should or should not redistribute wealth by heavy taxes on the rich?” Fifty-two percent answered yes to heavily taxing the wealthy. Despite this popular movement, many high net worth individuals do not think of themselves as wealthy, and therefore, do not believe they will be targets of future tax increases.

The terms rich, high net worth, and wealthy mean different things to different people. In our experience, most affluent households believe their financial net worth ranking is lower than government statistics suggest. The Federal Reserve’s 2016 Survey of Consumer Finances found that individuals with a net worth greater than $2.4 million would be included in the top 5% of all Americans.5 Individuals who exceed this level might meet society’s interpretation of rich, high net worth, or wealthy and may be the recipients of increasing taxes in the future.

Challenge Three – Headwinds Created by Changing Demographics

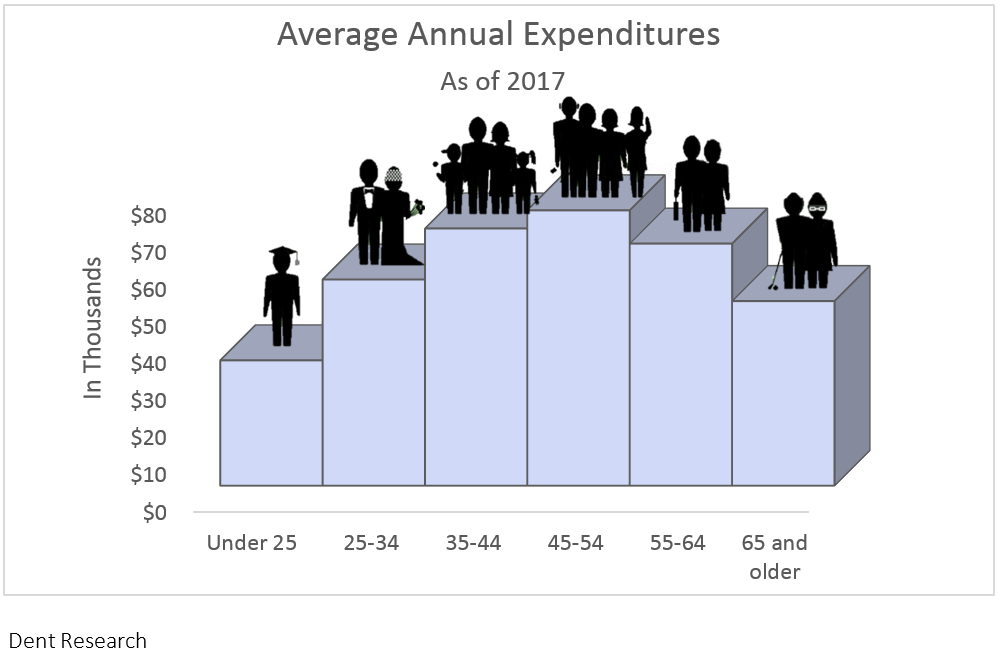

Baby Boomers entering retirement will likely create two distinct headwinds affecting both the stock market and tax rates.

Stock Market Headwind

U.S. businesses may be negatively affected by a lack of consumer demand as Baby Boomers reduce their spending during their retirement years. Lack of spending from this large group of U.S. citizens could lead to lower revenues, which could lead to deteriorating stock market valuations. Additional downward pressure could be placed on the stock market as Baby Boomers begin to sell stocks from their nest eggs to supplement their retirement income.

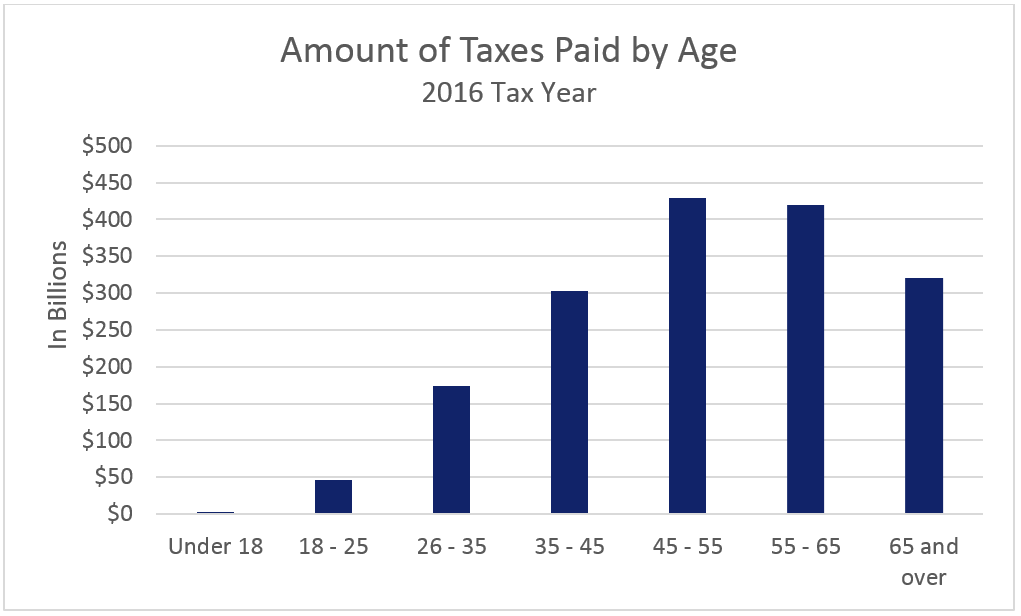

Tax Headwind

Source: bls.gov

It may not come as a surprise that people in their working years pay the bulk of individual income taxes. Tax pressure will continue to increase as the number of individuals collecting Social Security and Medicare continues to rise, while the number of Baby Boomers contributing taxes towards these benefits decreases as they exit the workforce. The Social Security Administration, in its 2017 Agency Financial Report, projects that in 2034 the Social Security Trust Fund reserves will be depleted, and states that the policy reforms being considered in light of this include raising payroll taxes.

Strategies to Cope

What can you do about these headwinds?

In every problem lies an opportunity. There are investment strategies that aim to help mitigate risks such as inflation or high stock market valuations. By using appropriate strategies, you can also help minimize the effects of potentially higher future tax rates. It is possible to permanently shelter assets from future income taxation. Most tax-minimization strategies either save for today or tomorrow. Focus on tomorrow.

Definitions and Disclosures:

Consumer Price Index: The Consumer Price Index (CPI) is an index representing the rate of inflation of U.S. consumer prices as determined by the U.S. Bureau of Labor Statistics. It is determined through a monthly survey of various consumer goods and services including housing, food, fuel, transportation, electricity, etc. Not Seasonally Adjusted. Source: Thomson Reuters