The dog days of summer brought a whirlwind of economic news, market movements, and shifting consumer sentiment in July. The month was defined by a delicate balance: a surprisingly resilient economy and a robust stock market, all while navigating a complex web of evolving trade policies, persistent inflation concerns, and continued uncertainty around geopolitical issues.

As we edge closer to sending the kids back to school and the return of football, we wanted to provide a snapshot of where we stand on a variety of market-related headlines.

Key Takeaways:

Strong GDP rebound: The U.S. economy bounced back with 3.0% growth in Q2 despite some underlying softness.

Inflation stays sticky: Prices remain above the Fed’s 2% target, fueled by tariffs and goods costs.

Mixed job market: Modest payroll gains offset by large downward revisions in previous months.

Trade tensions ease: New agreements with the EU and Japan reduce fears of a full trade war.

Tech leads markets: Stocks rally, driven by mega-cap tech and optimism around AI.

Consumer caution: Confidence is up but spending remains guarded amid inflation worries.

Solid footing ahead: Economy holds steady, but inflation and trade risks persist.

The Economic Landscape: Growth and Headwinds

July’s key economic headlines painted a picture of an economy that is holding its own, but with some notable caveats. The most significant news was the revised second-quarter GDP report, which showed the U.S. economy expanding at a 3.0% annualized rate.1 This marked a significant reversal from the 0.5% contraction in the first quarter, suggesting the economy had bounced back from earlier headwinds.

However, this headline number requires a closer look. A large part of this growth was attributed to a sharp decline in imports, which followed a period of aggressive stockpiling by businesses earlier in the year in anticipation of new tariffs.

This suggests the growth might not be entirely sustainable and masks some underlying weakness. A core measure of GDP, which strips out volatile components like trade and inventories, showed a more modest 1.2% growth rate, the slowest since late 2022.1

The Labor Market

The labor market, a perennial focus for policymakers and consumers alike, also presented a mixed bag. The July jobs report showed a modest gain of 73,000 nonfarm payrolls, a number that has been relatively stable since April.1

However, a major revision to the May and June numbers — a combined downgrade of 258,000 jobs — painted a weaker picture of the spring and early summer labor market than previously believed.1

While the unemployment rate remained stable at 4.2%, and near-term job growth in sectors like health care and social assistance was strong, the overall slowdown in payroll growth raised concerns about the impact of trade policies and stricter immigration enforcement.

Inflation

Inflation remained a central concern. The Consumer Price Index (CPI) for June, released in mid-July, showed a modest monthly increase of 0.3%, bringing the annual rate to 2.7%.1

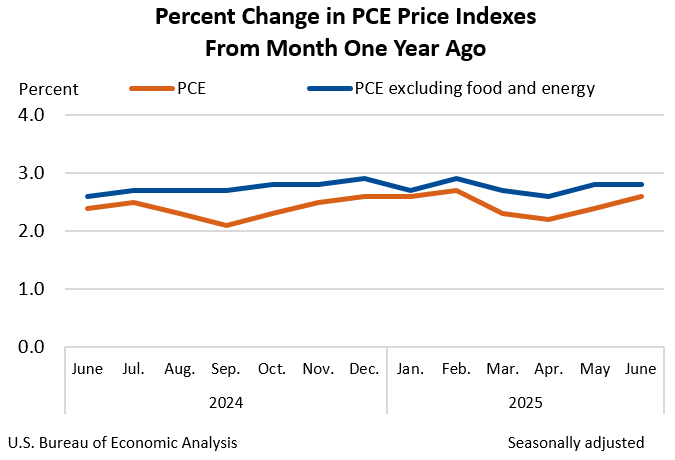

The Federal Reserve’s preferred measure, the Personal Consumption Expenditures (PCE) price index, also showed an uptick, with the annual rate rising to 2.6% in June from 2.4% in May.2 This suggests that while inflation is moderating from its post-pandemic peaks, it remains stubbornly above the Fed’s 2% target.

A significant driver of this inflation, particularly in goods like furniture and appliances, appears to be the recent round of tariffs. The good news is this has been offset somewhat by a softening in shelter prices.

The Fed, Tariffs, and Political Pressure

The political and economic drama surrounding the Federal Reserve reached a fever pitch in July. Fed Chairman, Jerome Powell, remained steadfast in his data-dependent approach despite calls from President Trump for lower rates.

At its July 30th meeting, the Federal Open Market Committee (FOMC) held its benchmark interest rate unchanged for the fifth consecutive meeting. The decision shined a light on the conflicting economic signals: a solid headline GDP figure, but persistent inflation concerns fueled by tariffs.2 Powell reiterated that the central bank was committed to its inflation target and would need more time to assess the long-term impact of the new trade policies before considering any rate changes.

Our view presently stands that tariffs are likely to be a one-time inflationary impact, the degree of which will be based on how broad the eventual tariff landscape becomes. It’s a continually evolving situation that changes by the day.

Trade policy itself was a major market driver. After a period of intense uncertainty, the month ended with some clarity. President Trump’s administration reached a framework trade agreement with the European Union, which imposed a 15% import tariff on most EU goods, averting a full-blown trade war.

A similar agreement was struck with Japan, lowering auto tariffs. These developments, which brought some stability to global trade, were welcomed by markets, even as the tariffs themselves raised concerns about higher prices for consumers.

Stock and Bond Markets: A Tale of Two Stories

The stock market had a banner month, with major indices extending their gains. The S&P 500 posted its third consecutive monthly advance, climbing approximately 2.2%, while the tech-heavy NASDAQ once again outperformed, gaining 3.7%. The Dow Jones Industrial Average lagged but was still up 0.2% for the month.

The market’s performance was largely driven by continued strength in mega-cap technology stocks, particularly the so-called “Magnificent Seven.” Bolstered by optimism around artificial intelligence (AI) and strong second-quarter earnings reports, these companies were the primary engines of the market’s gains. This concentration of returns in a few large companies sparked renewed debate about market-breadth and concentration risk.

In contrast, the bond market was relatively muted. The 10-year Treasury yield inched higher, ending the month at 4.37%, reflecting the improvement in growth outlook but also growing fiscal concerns. The expectation of continued government spending, as well as the Fed’s unwavering stance on interest rates, proved to be a headwind for bond returns.

The Consumer Pulse: Cautious Optimism

Finally, consumer sentiment showed signs of stabilizing, though it remains a mixed bag. The Conference Board’s Consumer Confidence Index improved slightly in July, rebounding from a sharp decline in April.3 Consumers were feeling less pessimistic about the future, particularly regarding business conditions and the labor market. However, their assessment of the present situation was little changed.

The University of Michigan’s Consumer Sentiment Index also rose for the second consecutive month in July, though it remains well below levels seen at the end of last year. 4 The survey highlighted a split in consumer attitudes, with those holding stocks feeling more optimistic due to the strong equity market, while those without stock holdings were less sanguine.

Both surveys indicated that consumer worries about tariffs and inflation persist, even as inflation expectations eased slightly from their peak. Purchasing plans for big-ticket items, like cars and homes, declined in July, suggesting that consumers are still exercising caution with their spending.

Overall, while there remain hurdles to leap over, we continue to believe the economy is on solid footing. Chances of a recession remain low, and policy question marks are getting answered.

Sources:

- Bureau of Economic Analysis (BEA)

- Bureau of Labor Statistics (BLS)

- The Conference Board

- University of Michigan Surveys of Consumers

Individuals showing a CFP® designation hold an active CERTIFIED FINANCIAL PLANNER™ certification. To earn the CFP® designation, the individual had to complete an approved educational program, pass a rigorous examination and meet stringent experience requirements. Designation holders also adhere to a professional Code of Ethics and fulfill annual continuing education requirements to remain aware of current planning strategies and financial trends. You can find more information about this designation at CERTIFIED FINANCIAL PLANNER™ (CFP®) Certification.

Individuals showing a CFA® designation hold an active CHARTERED FINANCIAL ANALYST™ certification. To earn the CFA® designation, the individual had to complete an approved educational program, pass a rigorous examination and meet stringent work experience requirements. Designation holders also adhere to a professional Code of Ethics and fulfill annual continuing education requirements to remain aware of current planning strategies and financial trends.