As many long-term readers of our newsletters may already know, the consumer is the lifeblood of the U.S. economy. Without individuals spending their hard-earned money on the goods and services we produce and import as a nation, we wouldn’t grow. We are a consumption economy by definition.

This is also the reason we pay as much attention as we do to the health of the consumer. A healthy consumer can be defined in many ways. Simple metrics such as retail sales, consumer sentiment, job growth, and unemployment rates all provide a glimpse of the consumer’s story. However, to truly understand the current state of the consumer, we need to look within these metrics and break them apart piece by piece.

The AI-Powered Economy

Let’s begin by saying that at a high level, the American economy continues to be on stable footing. The Atlanta Fed’s GDPNow model suggests third-quarter GDP will grow at a rate of 4%. This is well above the long-term average for our economy, suggesting we must be doing something right! But let’s take a closer look at what’s driving this economic momentum.

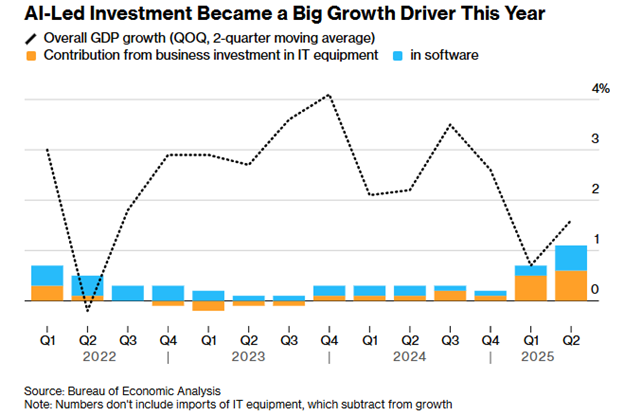

The chart below shows how much our economy has grown quarter over quarter since the beginning of 2022. The dotted line is the average GDP over the previous two quarters, while the blue and yellow bars below show the contribution to GDP from IT equipment and software spending.

Historically, this kind of spending focused largely on building data centers for cloud computing, developing infrastructure for the “Internet of Things” and the software associated with running all this technology. Today, this spending is largely concentrated on artificial intelligence and the development of large language models.

The reason this is important to distinguish is that the amount of money being spent on AI development has accounted for a vast majority of GDP growth since the beginning of 2025. Without this investment, the economy would be growing at a much slower pace, or even potentially contracting.

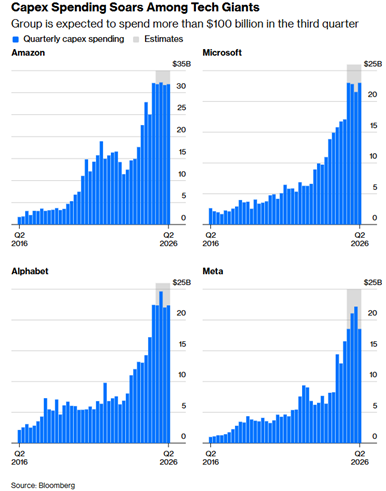

Anyone who has been paying attention to the stock market knows this spending has been coming from some of the largest companies in the world. Amazon, Microsoft, Alphabet (Google), and Meta are cumulatively going to spend over $350 billion in 2025 alone in capital expenditures. Most of which is directed at developing AI models and the associated infrastructure to power them.

The biggest question then becomes “What happens if AI is a bust?”. If these companies turn off the spending spigot and go back to their spending habits earlier in the decade, what does that mean for the economy? While GDP might take a hit in the near-term, the levels of spending concentrated in one area of the market seem unhealthy long-term. A robust economy is defined as one with breadth across goods and services. This diversification helps when one segment slumps, others can pick up the slack. When we have one segment of the economy dominating growth, we see this as a potential risk moving forward.

Can the Consumer Remain Resilient?

Amongst all this AI spending is the consumer. Those with assets in the stock market or jobs linked to AI development are feeling very positive at the moment. Unfortunately, those less fortunate do not feel as positive.

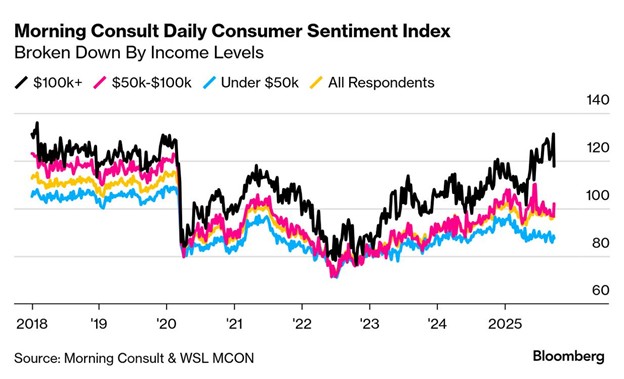

As we mentioned at the beginning, to truly understand the state of the consumer at this moment in time, we must look beyond the headline data and peel apart the underlying pieces. A great example of this is consumer sentiment.

If you were to look at the headline consumer sentiment figure, you would see it’s been trending up since the middle of 2022 and has flatlined somewhat during 2025. That’s not the worst thing in the world, as sentiment can be a fickle indicator. The long-term trend appears positive.

However, if you break out the sentiment readings by income levels, a very different picture is painted. Respondents who make over $100k annually have seen their sentiment continue to rise since the nadir in 2022. Whereas respondents who earn under $50k annually have seen sentiment materially deteriorate since the beginning of 2025.

It’s not wrong to assume different income cohorts will have varying degrees of sentiment. The data clearly shows this year-over-year. What’s concerning, though, is when they begin to move in opposite directions.

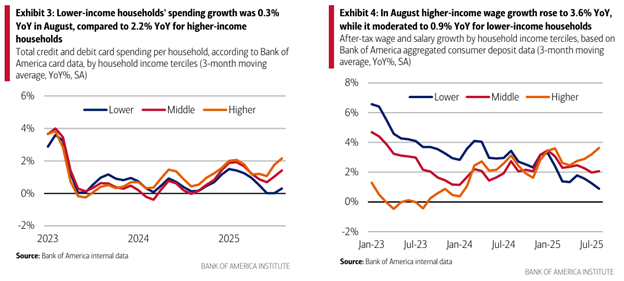

We see the same bifurcation in spending data as well. Bank of America’s consumer scorecard shows higher income earners’ spending growth rising throughout 2025, while lower income earners’ spending contracts. Wage growth is also declining for lower-income earners, while at the same time, higher-income earners see their wages grow faster than they have since 2022.

It’s important to keep in mind that while this data suggests some cracks are forming within our economic outlook, we’re not seeing any bright red warning signs either. Should the lower-income demographic continue to struggle, it might become harder and harder for the higher-income earners to spend enough to keep the overall economy moving forward. Separately, if the higher-income earners decide to pull back on spending, there’s little cushion beneath the surface of the economy to compensate for that lack of spending.

Despite these risks, it’s clear that the investment in AI is not going away anytime soon. Multibillion-dollar deals continue to be inked and quarterly guidance from the tech behemoths suggests no shortage of enthusiasm for the industry. We believe we’ll continue to see our economy grow and the consumer to spend throughout the holidays and into 2026.

From everyone at Bernicke, we wish you a happy and healthy Thanksgiving and a wonderful start to the holiday season!