Rationalizing The Irrational

As the father of three children ages 8, 5, and 2, I have the opportunity to deal with irrationality on a daily basis. No matter how gentle, sweet, or loving your children are, there inevitably comes a time when the only thing that will solve a crisis in their heads is a bowl of ice cream at 9 a.m. I used to think we were doing something wrong as parents during these times, but the reality is children can and will be irrational no matter how well they’re raised!

Even if you don’t have kids, adults carry the same capacity to act irrationally, though we often express it in ways other than crying and demanding ice cream. However, because adults run our modern world (despite our children’s best efforts to tell us otherwise) we often see examples of how irrationality pervades its way into our lives through a variety of avenues.

Irrationality in Finance: Valuation Bubbles

The classic example of this in finance and the stock market is when valuation bubbles form. Interestingly enough, there’s a formal line of academia studying how humans think about finance called “behavioral finance”. When you combine psychology and finance you can see how basic human emotions can push stock valuations beyond what any rational investor may suggest through hard data.

In today’s environment, whispers are beginning to form about the exuberance surrounding artificial intelligence (AI). Corporate America is spending billions of dollars investing in AI as companies race to develop the best AI-based tools for their customers. This is despite the fact that many of these same companies are not seeing the additional revenue generated to offset the incredibly expensive investment that underlies AI technology. Venture capital firm Sequoia estimates companies have spent over $50 billion on investing in the computer chips used to develop AI tools but earned only an additional $3 billion in revenue. That’s an incredibly hefty investment for not a lot of return, at least in the near-term.

When taken in the context of the stock market, we’re seeing the valuations of stocks at the forefront of the artificial intelligence revolution get to levels suggesting irrationality may be working its way into the psyche of the market.

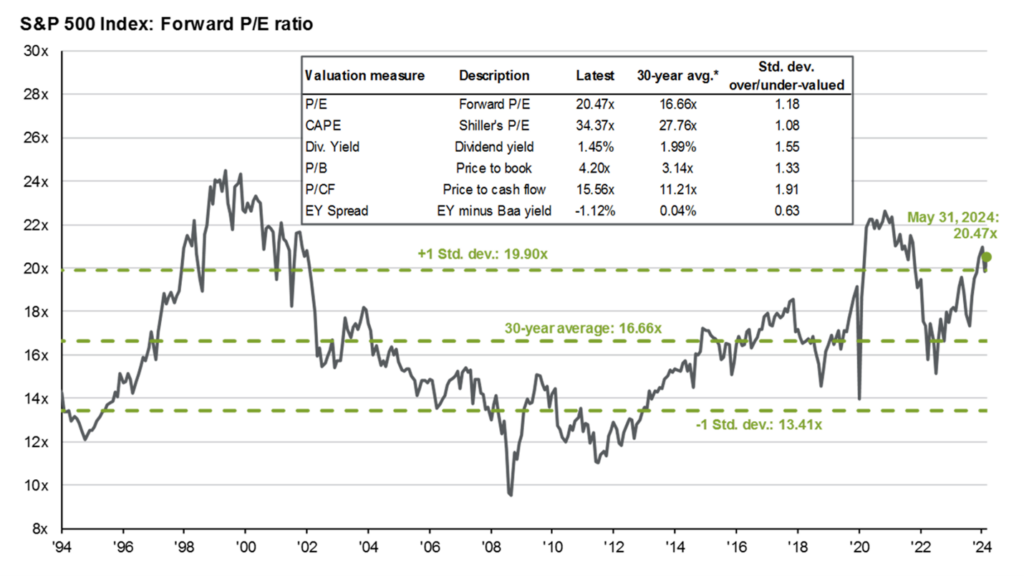

There’s an often-quoted data point called the forward P/E analysts use to determine how cheap or expensive a stock is relative to what they’re expected to earn in the future. The P/E stands for price divided by earnings. Simply put, you take the current price of a stock, and you divide it by what you expect that stock to earn per share over the next 12 months. Over the last 30 years, the average forward P/E of all the companies in the S&P 500 Index is around 16.6. As of May 31, 2024, the forward P/E for the S&P 500 is 20.5.

Historical Context and Future Outlook

To put this into context, when you exclude the massive valuation swings during the peak of COVID, the last time the forward P/E was this high was during the dot com bubble in 1999-2001.

A rational investor may look at current valuations and suggest the market is overvalued relative to where it has been in the past. However, that same rational investor may look at what happened during the dot com bubble and suggest the market can stay irrational for a lot longer than one would expect given it took a few years for valuations to normalize. Even further, that same investor may believe the AI investments being made today are truly the beginning of a new supercycle in the economy and today’s valuations are justified given how pervasive AI technology will become in our everyday lives, similar to the launch of the iPhone in 2007.

Maintaining a Balanced Investment Philosophy

Just like demanding a bowl of ice cream for breakfast in the morning, it’s easy to dismiss the irrationality of the market as a fleeting theme that will soon burn itself out. The stock market has a history of being irrational, and with hindsight in our corner, it’s easy to point out bubbles after they have already burst. Alternatively, it’s incredibly difficult to point them out while you’re in one, and despite all the prognosticating on both sides of the argument, nobody knows for certain what will happen in the future.

We seek to maintain a balanced sensibility with our investment philosophy based on data, not emotion. With that in mind, we do believe valuations are stretched as we see them today, though pinpointing when or if those valuations return to normal would be as irrational as a toddler eating a bowl of cookie dough ice cream alongside their Cheerios.