Oil Market Dynamics Are Out Of Whack

Having a conversation around gas prices is somewhat similar to death and taxes: They’re all unavoidable! I’m comfortable in saying most of us likely had a conversation with a relative over the holidays that revolved around how much gas prices have come down these past few months. It’s an easy icebreaker to use with those you may only see a few times a year. Electric vehicle owners are not immune to this dynamic either. Instead of talking about the price at the pump, you’ll find them discussing the cost per kilowatt hour to charge up at home.

Even though the menial chat around gas prices may not excite most, it’s becoming more difficult to brush aside given the way energy prices have been reacting to a slew of recent headlines. That is to say how little prices have been reacting considering the impact these headlines would historically have. It’s enough to warrant a deeper conversation beyond the platitudes of a classic conversational icebreaker.

For starters, let’s set the stage for how oil prices would traditionally react to various news items.

- OPEC+, the organization that collectively governs almost half of the total oil output on Earth, has historically had a massive impact on oil prices when they announce production cuts or hikes. If OPEC+ announces a cut to their production, oil prices generally increase in reaction to less oil supply and vice versa.

- Global demand and economic growth are closely tied to oil prices as well. If large economies encounter growth headwinds and consumer demand drops due to increasing unemployment or fewer miles traveled, oil prices could fall as there’s less consumption and therefore increased supply in the market.

- Geopolitical instability, especially in the Middle East, can have a profound, albeit at times temporary, impact on oil prices. If a country like Iran, which produces a little over 2.5% of the world’s oil supply, gets pulled into a conflict, domestically or internationally, oil prices could increase on the risk that Iran’s oil supply is disrupted and may not make it into the marketplace.

At its very essence, we’re talking about supply, demand, and external factors unexpectedly impacting both. So, why do we think the current oil market dynamics are not having their normal impact on prices?

OPEC+ Control Is Slipping

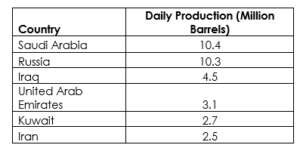

The top oil-producing countries represented within OPEC+ are as follows:

For reference, it’s estimated that in 2022 total daily global oil output was 93.9 million barrels. Even though OPEC+ includes the most aggregate oil production across its members, it excludes the largest daily producer overall, the United States. The U.S. produces around 13.3 million barrels of oil a day. This is the most our country has ever produced and far exceeds the production of every other oil-producing country. This means when OPEC+ decides to adjust their total oil output, it can have an impact on prices, but not nearly as large of an impact as it once had. This also assumes all countries within OPEC+ abide by the output restrictions, which is less of a guarantee given many countries within the cartel are struggling with their own domestic issues and rely on oil sales to manage their country.

Geopolitical Risks Lessen

Admittedly, geopolitical risks are very fluid and can change in an instant. With that being said, recent geopolitical events have triggered far less of a move in oil prices than one would have originally expected. The most recent of which being the Houthi attacks on shipping vessels throughout the Red Sea over the prior month. Oil prices moved modestly on the initial news but quickly reversed after markets assumed the conflicts would remain contained.

The same can be said for the Israel/Hamas conflict late last year. Oil prices rose to their highest of the year after the initial attack by Hamas. Once markets determined Iran wasn’t going to be a critical player in the conflict, oil prices retreated as neither Israel nor Palestine represent sources of oil production. The same story unfolded at the outset of the Russia/Ukraine war, albeit at a slower pace. Despite all the sanctions placed on Russia to prevent them from selling oil, the country found ways to sell its oil to willing buyers on the black market.

Historically, events such as those currently occurring in the Middle East would have created what’s called a “risk premium” on the price of oil. Meaning that the market was willing to buy more oil while conflict was occurring due to the risk the supply on the market could be disrupted. This additional buying would have the effect of increasing the price of oil. At this time, markets appear to be comfortable with the risks as none of the major oil-producing countries appears at risk of being drawn into a larger conflict.

Global Oil Demand Expected To Slow

As consumer spending slows, so does the economy where those consumers live. For 2024, economists are projecting the U.S. economy to grow around 2.3%. In the third quarter of 2023, our economy grew at an annual rate of 4.9%. This slowing of growth is expected as consumer savings balances normalize to pre-Covid levels and businesses slow their pace of hiring.

China is facing a similar story but for different reasons. In 2023, the Chinese economy expanded at a pace of 5.2%. Economists expect China to grow at 4.6% in 2024.

With consumers pulling back on spending, the demand for oil typically lessens as fewer dollars are spent on travel and other discretionary items. Fewer goods moving across the country means fewer truck shipments and therefore less diesel getting burned.

Generally speaking, predicting where oil prices are going to be in six months is as easy as predicting the exact temperature six months in the future. We generally know it’s going to be warmer in six months than it is now, but who knows what the exact temperature will be? With oil prices, the stage appears set for prices to remain somewhat rangebound for the time being, if not lower based on current supply and demand dynamics. Though there’s a whole host of catalysts that could change that dynamic overnight. Hopefully, none of which will demand more than another conversation point for your next gathering with your relatives.