What to Expect During an Election Year

When it comes to food, there are two types of people in this world. The first type of person finds a type of food or dish they like, and they stick with it. The second type of person is more adventurous and likes to explore different foods by frequently choosing to order something new on the menu almost every time they go out to eat.

Personally, I like to stick with what works. My reasoning for this can be attributed to my belief that the potential glory of finding a new food that I will love is far less likely than experiencing something new I don’t like. With that being said, both types of food people are okay. They’re just different.

There are also two types of investors. The first type of investor is always seeking out a new strategy that will provide him or her with greater returns for less risk. These investors will often seek out articles that tend to substantiate their belief system while shunning articles with conflicting opinions. The second type of investor focuses on sticking with tried-and-true strategies that have a long history of providing value. These investors tend to be more patient and are generally reluctant to buy into the latest investing fad. In a similar sense, I feel it is better to stay with tried-and-true strategies that focus on a few core concepts.

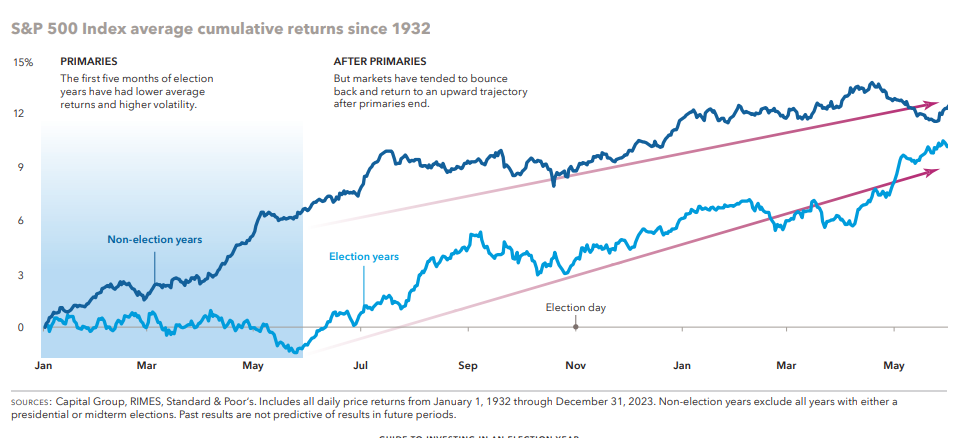

With 2024 being an election year, I feel that staying with tried-and-true strategies, even if they seem difficult or wrong at times, is important. The reason this may seem difficult can be attributed to the increased level of volatility that frequently accompanies election years. Perhaps the graph below, provided by the Capital Group, will illustrate this point1.

This graph contrasts the average rate of return for stocks during non-election years and election years. The following are a few key takeaways:

- During election years, stocks tend to have below-average returns that also tend to be more volatile through the first five months of the year.

- The subsequent twelve months following May of an election year tend to include above-average performance for stocks.

Many variables can help explain increased returns volatility during election years. Uncertainty surrounding the primaries early in the year and the presidential election in November may be partially to blame for heightened volatility in election years. Wars, immigration control, and the growing national debt may also be reasons that could cause heightened volatility in 2024.

However, despite many reasons for concern, there are also plenty of factors to be optimistic about regarding broad fiscal conditions. After excluding the magnificent 7 from the S&P 500 index, the remaining 493 stocks seem reasonably valued when compared with the historical P/E ratio of the index. Inflation seems to be slowing and consumer strength has been surprisingly resilient.

It is easy to understand how investors can get confused when weighing the positive signs against the negative signs. At Bernicke Wealth Management, we specifically avoid making investment decisions driven by emotional factors, but instead use what we believe to be tried and true, historically proven core concepts as our guide. As political and social tensions increase, the core concepts we follow become increasingly important, and we believe these principles provide a compass to point us in the proper direction, regardless of how disruptive the times are.

In general, sticking to our belief system encourages us to recommend balanced portfolios that strategically underweight or overweight various categories of investments.

As always, we truly appreciate your business and hope that you can find some peace in these disruptive times. We also hope you continue to favor a balanced approach to investing, even if your emotions are telling you otherwise.

Finally, I hope you either continue to enjoy your favorite foods, or I hope you find some new favorites, depending on what type of food person you are.

Enjoy the remainder of your winter!

Sources

- Capital Group. “S. Outlook: Maintain Balance in this Election Year.” Capital Group, 2020. https://www.thecapitalideas.com/articles/outlook/us-outlook. Accessed 21 Feb. 2020.

This article is provided by Bernicke Wealth Management, Ltd. (Bernicke) for informational purposes only and should not be regarded as a complete analysis of the subjects discussed. No portion of this commentary is to be construed as the provision of personalized investment, tax, or legal advice. Neither Bernicke nor Triad Advisors, LLC provide tax or legal advice. Before making any decisions with legal or tax ramifications, you should consult the appropriate professionals for advice that is specific to your situation.

Past performance is no guarantee of future results. Investing involves the risk of loss, and investors should be prepared to bear potential losses.

Certain information contained in this article is derived from sources that Bernicke believes to be reliable; however, Bernicke does not guarantee the accuracy or timeliness of such information and assumes no liability for any resulting damages. The information contained in this article does not purport to be a complete description of any securities, markets, or developments referred to herein. The information presented herein is subject to change without notice and should not be considered as a solicitation to buy or sell any security. All such information is presented solely for convenience purposes only and all users thereof should be guided accordingly. Any opinions are those of Bernicke and not necessarily those of Triad Advisors, LLC. There is no guarantee that the views and opinions expressed in this presentation will come to pass.

Bernicke is an SEC-registered investment adviser maintaining a principal place of business in the State of Wisconsin. Registration does not imply a certain level of skill or training. Bernicke may only transact business in those states in which it is notice-filed or qualifies for a corresponding exemption from such requirements. For information about Bernicke’s registration status and business operations, please consult the firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov.

Any reference to a market index is included for illustrative purposes only, as it is not possible to directly invest in an index. Indices are unmanaged, hypothetical vehicles that serve as market indicators and do not account for the deduction of management fees or transaction costs generally associated with investable products, which otherwise have the effect of reducing the performance of an actual investment portfolio.

The information contained in this article does not purport to be a complete description of any securities, markets or developments referred to herein.

Securities offered through LPL Financial, Member FINRA/SIPC. Investment advice offered through Great Valley Advisor Group, a registered investment advisor. Great Valley Advisor Group and Bernicke Wealth Management are separate entities from LPL Financial.