While we in the finance industry like to believe data is the arbiter of truth, the reality is far more complex than the headline numbers.

Much of what is being discussed about the health of the economy comes at a time when both sides can make an argument they’re right.

When data tells a conflicting story, what should you believe?

An everyday example of this could be when you go out to eat. Let’s say you order McDonald’s from a drive-through and ask for a cheeseburger with a large fry. It costs you $5, which you pay at the first window, followed by receiving your order from the second window. However, once you drive away, you find they gave you a small fry instead of the large you paid for.

If we look at this example strictly through the data, we can see two things. First, McDonald’s earned $5 and can show consumers are still purchasing their food – a positive sign for McDonald’s. However, if you were to be surveyed, you’d probably give McDonald’s negative feedback for getting your order wrong. This sentiment might skew the outlook for McDonald’s lower due to negative consumer sentiment.

The “hard data” – the money earned by McDonald’s – shows a positive outcome. The “soft data” – the consumer’s sentiment towards McDonald’s – shows a negative outcome. Both are technically correct!

Understanding Soft and Hard Data

We can use this same premise when analyzing the health of the U.S. economy. Economists, policymakers, and investors rely on two types of data: soft data and hard data. While both offer valuable insights, they often tell different—and sometimes conflicting—stories about economic conditions. Understanding the distinction between them and how to interpret their signals is crucial for making informed decisions.

The Difference Between Hard and Soft Economic Data

Hard economic data refers to objective, quantifiable indicators that are derived from actual economic activity. These data points are measured and reported by government agencies and institutions. Examples such as Gross Domestic Product, employment reports, inflation metrics, and retail sales are considered hard data.

Hard data is valuable because it is based on real transactions and activities. However, it often comes with delays due to the time required for data collection and verification. Revisions to previously reported numbers can also alter the narrative of past economic conditions.

Soft economic data consists of surveys, sentiment indices, and expectations about the economy. This type of data is based on opinions, forecasts, and subjective assessments rather than direct measurements of economic activity. Examples include consumer sentiment surveys, market sentiment indicators, and business sentiment surveys.

Soft data is timely and forward-looking, which can provide an early warning of economic shifts before they appear in hard data. However, sentiment can be influenced by factors such as political events, media narratives, and temporary shocks, making it susceptible to volatility and potential bias.

One of the most challenging aspects of economic analysis is when soft and hard data diverge. At present, the soft data is suggesting a negative outlook, whereas the hard data shows a stable economy. This suggests that despite solid economic fundamentals, public perception is skewed negatively. This often occurs during periods of rising inflation or political uncertainty, where consumers and businesses may feel worse than actual conditions justify.

Current Economic Trends

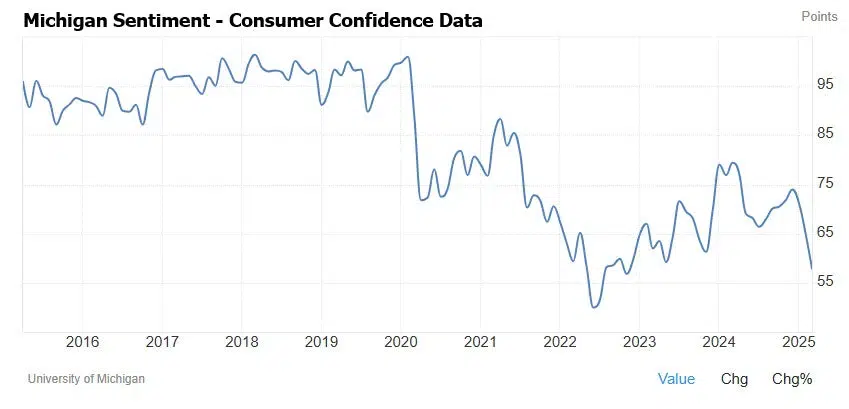

As of recent months, we’ve seen an interesting divergence between soft and hard data in the U.S. economy. Consumer sentiment surveys have shown pessimism due to inflation concerns and high interest rates, while hard data, such as job growth and retail sales, remains resilient.

For example, the University of Michigan’s Consumer Sentiment Index fell sharply in early 2025, reflecting concerns over affordability and economic uncertainty. Meanwhile, non-farm payrolls showed continued job growth, and GDP expanded at a solid pace. This disconnect highlights how sentiment can lag real economic performance—or, conversely, how expectations of a slowdown may eventually materialize in future hard data.

How Should You Interpret Economic Data?

Both soft and hard economic data play a crucial role in understanding the state of the U.S. economy. Hard data provides a factual basis for analysis, while soft data offers valuable insight into the sentiment surrounding the economy. By assessing both types in tandem, we can make more informed decisions. It’s important to keep an eye on trends and not any single data point as we plan for the future. While there may be a lot of noise to sift through, remaining grounded in our long-term, core fundamentals will make planning through the volatility much easier.

Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All investing involves risk including loss of principal. No strategy assures success or protects against loss.