There are many factors to consider when determining your ideal age for taking Social Security income, including your future investment returns, future inflation rates, your life expectancy, Social Security solvency, potential impacts of reform, health status, financial situation, estate goals and future retirement spending patterns, to name a few. By understanding the factors that are representative of your situation, you can increase the likelihood of determining your ideal Social Security start date.

Our firm has helped hundreds of people determine an appropriate Social Security claiming strategy for their unique circumstances, and we have also been fortunate to observe how these decisions have affected their retirements. What we have learned over the years might surprise you.

We have learned there is a significant amount of misinformation surrounding the best age to take Social Security income. Some argue that it is better to start taking Social Security as early as 62 to maximize the number of years that a recipient will receive income throughout retirement. Others argue the benefits of delaying Social Security as late as age 70 because delaying benefits to a later age will entitle a recipient to receive a higher benefit amount for the rest of their lives.

The right choice for each person is highly dependent on a number of different factors … some of which don’t always get mentioned, and can impact your decision on when to take Social Security benefits. This article addresses the key factors that may influence your decision to take Social Security earlier or later, as well as some basics to help you understand Social Security.

Break-Even Age

Before we look at the research, it’s important to understand something commonly referred to as break-even age. Break-even age is the age that a recipient would have to live to in order to benefit from delaying their Social Security income beyond the early start date age of 62. This is important because if Social Security income is started at 62, the recipient will receive payments for more years, but will also receive a lower benefit amount for the rest of their lives when compared with if they had delayed claiming their benefit.

Source: The Standard.1 Caclulated using FRA of 66; monthly benefit at 62 of $1,000, monthly benefit at age 66of $1,200, monthly benefit of $1,600 at age 70.

Assumptions

Social security retirement income is illustrated based on your inputs. Actual social security benefits may differ, depending on your earnings history and other factors, such as actual government cost-of-living adjustments.

These results are hypothetical, and are for illustrative purposes only.

All monthly benefits are presumed to be paid over a 12-month calendar year, although benefits actually paids in the first year of election are often paid over a period shorter than 12 months.

Taxes are not factored into the calculation of cumulative benefits.

A Look at the Research

The graph on the previous page illustrates the break-even age using a simplistic approach. This standard analysis is consistent with much of the literature. Unfortunately, many of these studies ignore key factors when comparing different start dates. In an effort to provide a more comprehensive perspective on this topic, I am going to summarize an analysis that was originally published in the Journal of Financial Planning.

A More Comprehensive Study: Doug Lemons

Retired Social Security Administration executive, Doug Lemons, did a comprehensive analysis on how long someone would have to live in order to justify starting their Social Security at age 62 versus age 66. He also did a second analysis that compared taking benefits at age 66 versus age 70. (These are important ages to test as 62 is the earliest date most people can start Social Security and 66 is the approximate age. Where many people born between 1943 and 1954 will turn their full retirement age, and 70 is the age when Social Security benefits will no longer earn delayed credits).

A Missing Factor

Lemons’ research tested several different assumptions including incorporating the impact of various tax implications and inflation rates. He also included one key factor that many analyses leave out. The key factor he included in his research illustrates what would occur if a 62 year old recipient invests their monthly benefit until age 66 thereby earning interest on that money which will be used as a nest egg to supplement future Social Security and other retirement income.

Despite the fact that this may not be practical for some to implement, it is essential when trying to compare the early claim date versus a later claim date. Without incorporating this factor, which many studies fail to do, it’s like comparing apples to oranges and giving the appearance that the break-even age is younger than it may actually be. Lemons repeats this same process when comparing claiming Social Security at age 66 versus age 70.

The Results

Lemons found that the break-even age, when you contrast taking benefits at age 62 versus 66, to be somewhere between the ages of 81 and 86.5, depending on a variety of different assumptions analyzed regarding tax rates, inflation and other factors. He performed a similar analysis on taking Social Security at 66 versus 70 and found the break-even ages to be somewhere between 84 and 87.

So, someone who chose to claim their Social Security at age 66 versus age 62 would have to live longer than the range of 81 – 86.5 years old to justify that decision, and someone choosing to claim their Social Security at age 70 versus age 66 would have to live longer than the range of 84 – 87 years old.

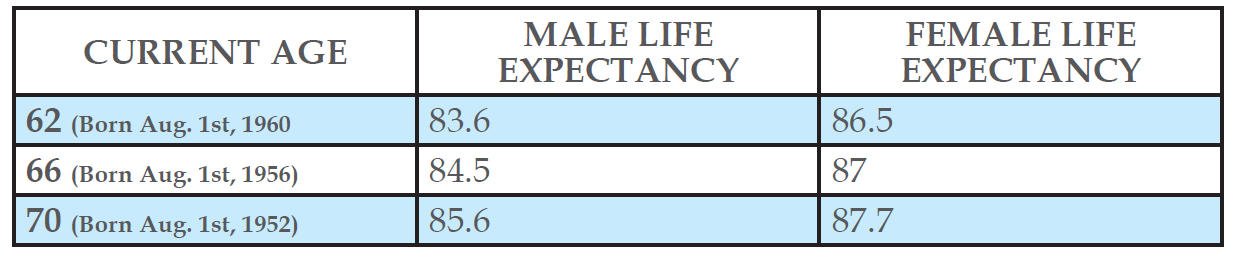

The Factor of Life Expectancy

To put this into perspective, it is worth analyzing current life expectancies. Presently, a 62-year-old male has an average life expectancy of 83.6 years, and a 62-year-old female’s average life expectancy is 86.5 years. The life expectancy for a male age 66 is 84.5 years, and a 66-year-old female can expect to live to age 87. Finally, a 70-year-old male can expect to live 85.6 vs. 87.7 for a female.

Source: SSA Life Expectancy Calculator, https://www.ssa.gov/oact/population/longevity. Estimate as of February 8, 2023.

Coincidentally, the average life expectancies are very similar to the break-even ages, which is exactly how the Social Security program was designed to work. I find many research studies that ignore some of the key factors mentioned previously tend to suggest younger break-even ages, thereby promoting later Social Security start dates.

Understanding the Basics of Social Security

Before discussing different factors that may push the break-even age earlier or later it is important to understand some basics surrounding Social Security. Understanding the basics and how they apply to your circumstances will help you decide when to take Social Security income.

Full Retirement Age (FRA)

The Social Security Administration defines Full Retirement Age (FRA) as the age when someone can collect their full Social Security benefit amount. Currently, that age is 66 for people born between 1943-1954, and it gradually rises to 67 for those born 1960 or later. Eligible recipients can take a reduced benefit as early as age 62 or they can postpone their benefit and receive delayed credits each month they delay up until the age of 70.

Social Security Solvency

According to the 2023 Social Security Agency Financial Report3, the Social Security Trust Fund is projected to last until the year 2033 without any reform. After the year 2035, continuing income is projected to be sufficient to support expenditures at a level of 80 percent of program cost for the rest of 2033. Future reform to correct this shortfall could involve increasing payroll taxes, slowing the growth in Social Security benefits, finding other revenue sources, or increasing the expected returns of the OAS and DI Trust Fund reserves by investing the funds, at least in part, in private securities4.

Spousal Benefits

If both spouses are collecting Social Security income, and one spouse passes away, the surviving spouse is entitled to the higher Social Security benefit. For example, let’s assume a husband’s benefit is $20,000 per year and the wife’s benefit is $10,000 per year. Assuming the husband predeceases the wife, she would receive the equivalent of the husband’s higher benefit amount of $20,000 per year.

Cost of Living Adjustments (COLA)

It’s possible that your annual Social Security benefit may increase over time, due to adjustments the government makes called Cost of Living Adjustments (COLA). These adjustments are determined annually based on the Consumer Price Index (CPI), published by the Bureau of Labor Statistics. These are also referred to as inflation adjustments.

Taxes on Social Security Income

Depending on your income, you may be subject to federal tax on up to 85% of

their Social Security income. Depending on your state of residency, there is also the potential for state income taxes.

Taxes on Other Sources of Income

Social Security income can create additional taxation on other sources of income. For example, let’s assume that a retired couple who presently is not taking Social Security, is on the verge of being pushed from the 12% tax bracket to the 22% tax bracket. The additional income from Social Security may push them into that higher tax bracket, thereby resulting in higher income taxes being paid for that year when compared with if they had not claimed Social Security.

Social Security Earnings Limits

A Social Security recipient younger than their full retirement age, earning in excess of $22.320 in active income from a job in 2024 would likely have some or all of their Social Security benefit withheld. A different earnings limit applies in the year the recipient reaches full retirement age. In 2024, benefits will not be reduced as long as the recipient’s earnings are less than $59,520 for the months before he or she reaches full retirement age. Beginning with the month of full retirement age, there is no earnings limit.5

Social Security Impacts on Health Insurance

Some people who retire before age 65 and who don’t have health insurance provided by a past employer might seek to purchase health insurance on “the exchange” (healthcare.gov) prior to Medicare starting at age 65. This is commonly referred to as Affordable Care Act insurance. Depending on income level, people utilizing this as a health insurance option can receive significant tax credits used to offset the cost of this insurance. For some people, this can save in excess of $25,000 per year. Social Security income can reduce or eliminate these tax credits.

Social Security Benefits for Children

If you have elected to claim your Social Security benefits and you have a child or children under the age of 18, these children may also receive income from Social Security in addition to what you are receiving.

Key Factors to Determine When to Take Social Security Benefits

Below is a partial list of some of the factors that can affect the break-even age. Each of the factors are playing a tug-of-war match against each other, with some of the factors pushing the break-even date to an older age and other factors pushing the break-even date to a younger age.

Let’s look at what those key factors are that will help you determine if you should take Social Security benefits earlier or later.

Factors that Encourage an Earlier Start Date

You will not have active income from a job in excess of the earnings limit before you reach your full retirement age

You feel Social Security will be reduced in the future due to lack of government funding and the potential for Social Security reform

You feel that the taxes on Social Security income and other sources of retirement income will increase throughout your retirement

You have a dependent child, and you are younger than your full retirement age

You are single and have a family history of shorter life expectancies

You are married and both you and your spouse’s family have a history of shorter life expectancies

Your health is poor

You believe that your nest egg will earn a strong rate of return throughout your retirement

You believe that you will spend more early in retirement and believe that your spending needs will decrease throughout the remainder of your retirement

You feel that the inflation adjustment to Social Security will be high throughout your retirement

You want to preserve your nest egg for children and or other beneficiaries

You don’t have other resources and you need the income

You want greater liquidity in your early retirement years so taking Social Security early may reduce the burden of spending other investment accounts that could provide you with greater liquidity

You are married and you have a spouse who has a higher benefit than you who will be delaying their Social Security thereby ensuring you or your spouse will have the higher benefit regardless of who lives longer

Factors that Encourage a Later Start Date

You will be earning active income from a job in excess of the Social Security earnings limits prior to your full retirement age

You feel that Social Security will pay you 100% of your promised benefits in the future

Your Social Security benefit will disqualify you for tax credits that you could receive to offset Affordable Care Act insurance prior to receiving Medicare at age 65

You are single and you believe that you will live beyond the break-even age

You are married, have a higher benefit amount than your spouse, and believe either you and/or your spouse will live beyond the break-even ages mentioned previously

You are in good health

Longevity runs in your family

You believe inflation will be low throughout your retirement

You believe the rate of return you will earn on your investments earmarked for retirement will be low

You feel that the taxes on Social Security income and other sources of retirement income will decline throughout your retirement

In summary, there are many factors to consider when determining your ideal age for taking Social Security income. Depending on your unique circumstances, some of these factors should carry more weight than others. Before starting Social Security, we suggest doing a thorough analysis of the factors mentioned above to help you make your decision.

This is an updated version of Ty Bernicke’s article originally published in Forbes on July 26, 2019.

“What Is The Best Age To Start Receiving Social Security?” The Standard, , www.standard.com/individual/retirement/planning-tools-calculators/social-security-break-even-calculator. Accessed September 7, 2018.

“When to Start Collecting Social Security Benefits: A Break-Even Analysis.” Journal of Financial Planning, Doug Lemons, https://www.onefpa.org/journal/Pages/When%20to%20Start%20Collecting%20Social%20Security%20Benefits%20A%20Break-Even%20 Analysis.aspx

Annual Report of the Board of Trustees of the Federal OASDI and DI Trust Funds, 2023. Social Security Administration. https://www. ssa.gov/OACT/TR/2023/tr2023.pdf Accessed 29 July, 2019.

SSA Agency Financial Report, Fiscal Year 2022. https://www.ssa.gov/finance/2022/Full%20FY%202022%20AFR.pdf

OASDI and SSI Program Rates & Limits, 2022 Social Security Administration, 2022. https://www.ssa.gov/policy/docs/quickfacts/prog_ highlights/RatesLimits2019.html. 2023.

The use of Ty Bernicke’s research or publication of articles he has written does not indicate an endorsement of his work as an Investment Advisor. The publications did not receive compensation for publishing Mr. Bernicke’s work.

The views expressed represent the opinion of Bernicke Wealth Management. The views are subject to change and are not intended as a forecast or guarantee of future results. This material is for informational purposes only. It does not constitute investment advice and is not intended as an endorsement of any specific investment. Stated information is derived from proprietary and nonproprietary sources that have not been independently verified for accuracy or completeness. While Bernicke Wealth Management believes the information to be accurate and reliable, we do not claim or have responsibility for its completeness, accuracy, or reliability. Statements of future expectations, estimates, projections, and other forward-looking statements are based on available information and Bernicke Wealth Management’s view as of the time of these statements. Accordingly, such statements are inherently speculative as they are based on assumptions that may involve known and unknown risks and uncertainties. Actual results, performance or events may differ materially from those expressed or implied in such statements. Investing in equity securities involves risks, including the potential loss of principal. While equities may offer the potential for greater long-term growth than most debt securities, they generally have higher volatility. International investments may involve risk of capital loss from unfavorable fluctuation in currency values, from differences in generally accepted accounting principles, or from economic or political instability in other nations.