Determining if a Roth conversion is a good strategy for your financial plan can be a complicated decision. There are many nuances involved, such as health insurance costs, extra Medicare surcharges, taxes, and estate planning just to name a few. At the most basic level, to obtain value from a Roth conversion, you must experience a change in tax rate. With all else being equal, the tax benefits of a tax-deferred vs. tax-free account are the same when you do not experience a change in tax rate.

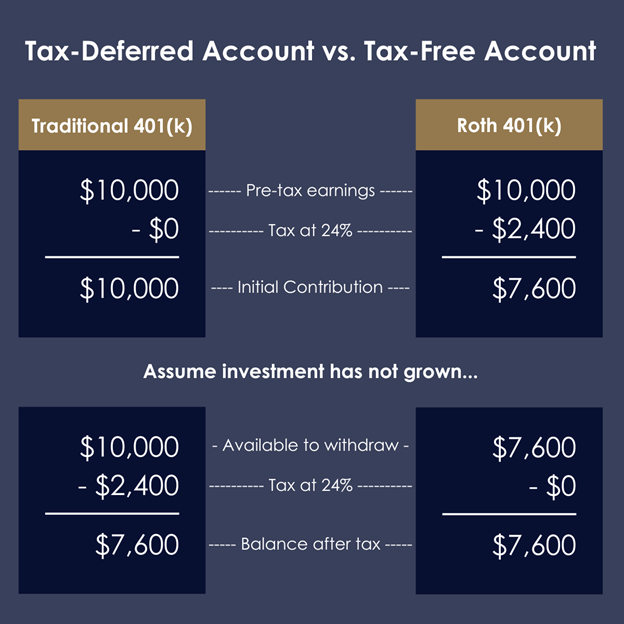

Here is an example of how the decision between the two can play out.

Scenario 1: Tax-Deferred Account

Sally is in the 24% marginal tax bracket when she decides to invest $10,000 into her traditional 401(k). Choosing to invest in the “tax-deferred” portion of her 401(k) plan means she is selecting to be taxed when she takes a withdrawal rather than the front end when she contributes. When Sally is ready to withdraw her investment, which for simplicity is still worth $10,000, she has remained in the 24% marginal tax bracket. Given this information, Sally can withdraw $7,600 after paying the taxes.

Scenario 2: Tax-Free Account

Let’s take this exact same scenario, but this time Sally chooses to invest in the Roth 401(k). By investing in the “after-tax” portion of her 401(k) she is selecting to be taxed upfront on her investment. After paying the 24% marginal taxes, she can invest $7,600. Again, for simplicity, her investment has not grown by the time Sally chooses to withdraw. Since she has paid the taxes upfront, she does not owe further taxes and can withdraw $7,600.

In this example, there was no difference in the value Sally received from choosing a tax-deferred or tax-free account. She has $7,600 in hand after taxes for both situations.

Knowing this simplistic principle is important to understand how a Roth conversion can add value to your financial plan. A Roth conversion is a tax-minimization strategy that allows you to transfer or “convert” retirement money from a tax-deferred account into a tax-free or otherwise called Roth account. When executing a Roth conversion, you owe ordinary income taxes on the

amount of money that is converted but permanently eliminate future taxation. Ideally, you utilize Roth conversions when you can pay taxes at a lower rate than what you would pay in the future.

This article will present ideas on how certain Roth conversion strategies can further maximize their value within your plan.

1. Roth conversions during low-income years

Oftentimes, people find they can live on a smaller retirement income than what they had during their working years. Being able to live on less income often places them in a smaller tax bracket than what they are accustomed to. Since their income is less, it provides an excellent opportunity to utilize the smaller tax bracket with Roth conversions.

2. Delay Social Security

Beginning Social Security benefits will limit the ability to utilize Roth conversions because it will allow for less room in the prospective tax bracket. Additionally, Social Security is only taxable up to 85% of your benefit on the federal level. This works essentially on a sliding scale. So, as your income increases, the percentage of your Social Security that is taxed increases. Using Roth conversions while taking Social Security may skyrocket the tax rate you are paying on the conversion because you are not only paying the tax on the money converted, but it forces more of your Social Security to be taxed as well. This is commonly referred to as a “tax torpedo”.

3. Choose the right place to pay for the Roth Conversions

When utilizing Roth conversions, there are multiple ways to pay the taxes. Depending on where the taxes are paid from can make a big difference in the value your conversion creates. Frequently, one of the best places to pay for the conversion is from your bank account. The next best place would be from your non-qualified investments, such as a brokerage account. The alternative to these options would be directly withholding taxes from the conversion. This means that less of your converted money will ultimately go into a tax-free account because a portion of it gets sent to the IRS. Keep in mind that if you are not 59.5 years old, withholding taxes from your conversion can result in a 10% penalty from the IRS. Paying from your bank or non-qualified investment allows the full amount of converted money to grow tax free. Selecting the right place to pay taxes accomplishes multiple objectives simultaneously. You are increasing your “good” retirement bucket and reducing the “bad” retirement bucket at the same time.

4. Utilize Roth Conversions during bad market years

Timing the market is never something our firm advocates for. However, there are times when the market offers opportunities to take advantage of certain strategies. Down markets allow you to get more bang for your buck for Roth conversions. When your share prices are down, you can convert the same amount of shares for less taxes than when the share price is up. This means you convert more shares per tax you pay. Converting more shares into a tax-free environment while the markets are down positions you to have more assets in a tax-free environment for when the market eventually recovers. It still makes sense to do conversions during the good market years, but bad markets provide an opportunity to get even more value for your conversions.

5. Convert at the beginning of the year vs. the end of the year

Have you ever heard the phrase, “Time in the Market beats timing the market”? Well, this general concept can work for Roth conversions as well. Historically the stock market has resulted in positive annual returns approximately 75% of the time. Meaning, if you were to invest at the beginning of the year, you would expect your investment to be worth more at the end of the year than what it was at the beginning 7 to 8 years out of 10.

When Roth conversions are executed at the beginning of the year, it allows for that conversion to have the entire year to grow in a tax-free environment. Over a long period of time, this subtle change in strategy can make a big difference. However, it’s important to keep in mind that there are certain considerations that make it more ideal to convert at the end of the year based on the complexity of your tax situation.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. Hypothetical examples used are not representative of any specific situation. Your results will vary.