As a sports fan, the cooler weather and the turning of the leaves are signs that some of the best months in sports are arriving. The MLB playoffs are in full swing, the NHL season gets underway, college football and NFL teams are already invigorating (or disappointing) each team’s respective fan base, and the start of the NBA season is just a few weeks away.

This time of year also marked the end of my son’s first season of coach’s pitch baseball. Because it was his first year not hitting off a tee, one common refrain we heard throughout the season was “Keep your eye on the ball!”. It’s the baseline phrase for any ball sport, really. “Skate to where the puck is going”, “Watch the ball all the way into your hands”, “Don’t lift your head while you swing”.

These expressions are all generally applicable to the world of finance as well. Well, maybe not the “lifting your head while you swing” phrase… In any case, knowing where the economy is today can be helpful, but we’d prefer to “skate to where the puck is going” when it comes to how we want to forecast the markets.

The consumer is the primary driving force for the economy. If the consumer stumbles, so does the economy and the stock markets along with it. Throughout this year we’ve seen a normalization of consumer trends. Credit card debt was increasing, but only back to levels we saw pre-2020. Bank lending was tightening, but the free flow of cash via COVID-related stimulus kept the consumer humming along.

These themes were prevalent if you were in the camp of a “soft landing” for the economy. However, if we’re looking to move to where we think the puck is going to be in the future, we need to forecast how these trends will continue into 2024.

Soft landing and the economy

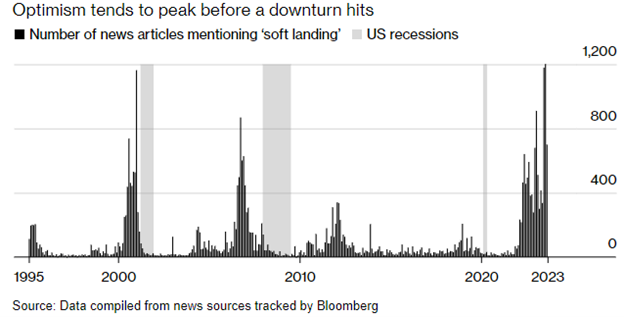

Let’s begin with the soft-landing narrative. A soft landing implies the economy will continue to grow, albeit at a slower pace, despite a restrictive policy stance from the Federal Reserve due to above average inflation. While a soft landing may still be in the cards, when everyone begins to coalesce around the same narrative it can be a potentially ominous sign.

The chart below shows the number of times the phrase “soft landing” is mentioned across news articles. As you can see, a buildup of consensus around a soft landing can at times foreshadow a recession.

Delinquency rates are increasing

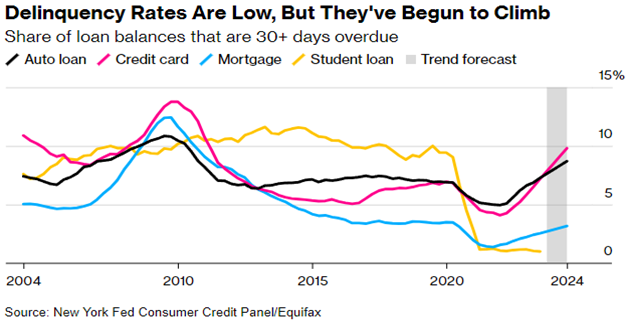

With regards to the consumer, the normalization process of debt may have been fully fulfilled in the sense that any continued increase in credit card or auto loan delinquencies could be viewed as a deterioration of the consumer vs. a normalization.

The chart below shows how auto loan and credit card delinquency rates have continued to increase beyond their 2019 levels in recent months. If the forecasts for 2024 are accurate, we’ll see these delinquency rates increase to levels not seen since the lead up to the Great Financial Crisis of 2008/2009.

The bright side of this picture is mortgage delinquencies are still well below 2008 levels and are not quite at 2019 levels. Student loan delinquencies are effectively zero due to the repayment moratorium, though this could change quickly once the moratorium is fully lifted.

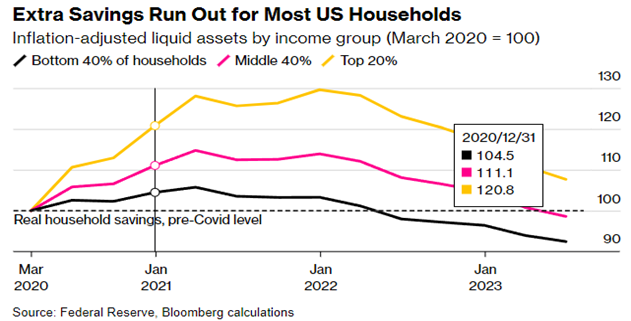

U.S. households see extra savings run out

Lastly, the excess savings balances consumers have built up may be fully exhausted soon. According to the following chart from the Federal Reserve and Bloomberg, when adjusted for inflation, the bottom 40% of households have fully spent down their COVID-related excess savings. The middle 40% of households are nearing excess savings levels pre-COVID, and the top 20% appear to still be in decent shape.

We continue to believe there’s a greater chance for a soft landing in 2024 than a significant recession. The main factors we’re “keeping our eye on the ball” on are the health of the consumer, government bond interest rates, and the trajectory of inflation. Even though some cracks may be appearing within the consumer, we don’t believe there’s reason enough to fully change course to an outright negative outlook.

The end of 2023, specifically the holiday shopping season, will likely be a telling sign for consumer confidence and their continued ability to spend and drive the economy forward in the midst of elevated interest rates and inflation.

If you would like a second look at how you’re positioned financially as we near the end of the year, you call our Certified Financial Planner™ professionals at 866-832-1173 or schedule a complementary consultation online in our Altoona, WI office or Woodbury, MN office.